pay estimated indiana state taxes

If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours.

Corporate Tax Rates By State Where To Start A Business

You must include Schedules 1 add-backs 2 deductions 5 credits such as Indiana withholding 6 offset credits and IN-DEP dependent information if you have entries on those schedules.

. Contact the Indiana Department of Revenue DOR for further explanation if you do. When figuring your estimated tax for the current year it may be helpful to use your income deductions and credits for the prior year as a starting point. How do I pay estimated taxes for 2020.

If you did make estimated tax payments either they were not paid on time or you did not pay. Some states also require estimated quarterly taxes. Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Indianas statewide income tax has decreased twice in recent years. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Estimated payments may also be made online through Indianas INTIME website. The tax bill is a penalty for not making proper estimated tax payments. You will receive a confirmation number immediately after paying electronically via INTIME.

Send in a payment by the due date with a check or money order. This form is for income earned in tax year 2021 with tax returns due in April 2022. You can also pay your estimated tax payments using the IRS2Go app.

Select the Make a Payment link under the Payments tile. For more information on the modernization. When filing you must include Schedules 3 7 and CT-40 along with Form IT-40.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Overview of Indiana Taxes. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form.

Learn about state requirements for estimated quarterly tax payments. Contact the Indiana Department of Revenue DOR for further explanation if you do. 430 pm EST.

Indiana Income Tax Calculator 2021. These local taxes could bring your total Indiana income tax rate to over 600 depending on where you live. This means you may need to make two estimated tax payments each quarter.

Line I This is your estimated tax installment payment. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income tax.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make.

Line I This is your estimated tax installment payment. You can send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or via your mobile device using the IRS2Go app. When you receive a tax bill you have several options.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. Send in a payment by the due date with a check or money order. It went from a flat rate of 340 to 330 in 2015 and then down to 323 for 2017 and beyond.

2021 IT-40 Income Tax Form. For a complete list of payment alternatives go to IRSgovpayments. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year.

If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments. These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July 18 2022. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am.

430 pm EST. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. We last updated Indiana Form ES-40 in January 2022 from the Indiana Department of Revenue.

Follow the links to select Payment type enter your information and make your payment. All 92 counties in the Hoosier State also charge local taxes. To make an individual estimated tax payment electronically without logging in to INTIME.

Those rates taken alone would give Indiana some of the lowest income taxes in the country but Indiana counties also levy their own income taxes in addition to the state tax. One to the IRS and one to your state. We will update this page with a new version of the form for 2023 as soon as it is made available by the Indiana government.

When you receive a tax bill you have several options. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. For more information on DORs tax system modernization efforts visit Project NextDOR at doringovproject-nextdor.

Your average tax rate is 1198 and your marginal tax rate is 22. Use your prior years federal tax return as a. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247.

More about the Indiana Form ES-40 Estimated.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Where S My State Refund Track Your Refund In Every State Taxact Blog

Hundreds Of Metro At T Employees Laid Off Just Before Christmas Fox 4 Kansas City Wdaf Tv News Weather Sports Before Christmas Metro Employee

Information About State Tax Refunds H R Block

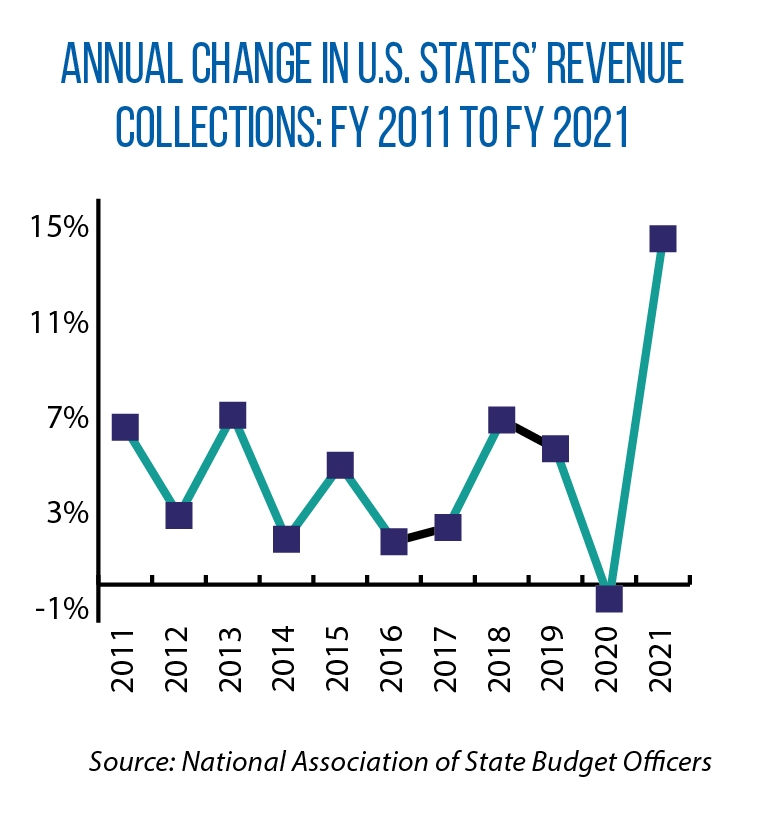

High Budget Reserves Trigger Automatic Refund In 2022 For Indiana Taxpayers Csg Midwest

Pin By Key Policy Data On Tax Burdens Burden Tax Income Tax

Minnesota State Chart South Dakota State

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Tax Burden By State 2022 State And Local Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Pay Indiana Taxes With Dor Intime R Indiana

A State By State Guide For Each Irs Mailing Address Workest

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Law Explanation And Analysis Of The Patient Protection And Affordable Care Act Pdf Download Preventive Care Child Health Insurance Health Care Reform

Is Indiana Tax Friendly Where Hoosier State Ranks Nationally

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)